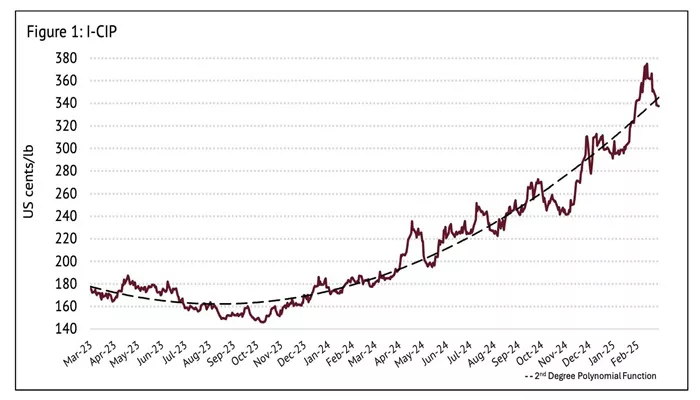

The International Coffee Organization (ICO) released its February 2025 market report, unveiling significant shifts in the global coffee market. The ICO Composite Indicator Price (I – CIP) reached an unprecedented monthly high, averaging 354.32 US cents per pound in February. This marked a substantial 14.3% increase from January’s figures.

The prices of Colombian Milds and Other Milds also witnessed notable hikes. Colombian Milds’ price rose by 16.7% compared to January, hitting 410.64 US cents per pound in February. Other Milds’ price increased by 15.5%, reaching 409.48 US cents per pound. The differential between Colombian Milds and Other Milds narrowed from – 2.54 to 1.16 US cents per pound between January and February.

The arbitrage, measured between the London and New York futures markets, expanded by 42.4% in February compared to January, soaring to 134.70 US cents per pound. This was its highest level since June 2022. However, the intra – day volatility of the I – CIP decreased by 0.6 percentage points, averaging 10.7% in February.

Stock levels also showed changes. London’s certified stocks of Robusta coffee declined by 4.9% from January to February, ending the month at 0.72 million bags. Arabica coffee certified stocks followed a similar but more pronounced trend, shrinking by 7.5% to 0.84 million 60 – kilogram bags.

Global green bean exports in January 2025 totaled 9.72 million bags, a 14.2% drop from the 11.32 million bags exported in the same month of the previous year. While Colombian Milds’ exports increased by 1.3% to 1.01 million bags in January from December 2024, Other Milds’ shipments decreased by 11% to 1.46 million bags in January compared to the same period in 2024. Brazilian Naturals’ green bean exports in January 2025 decreased by 1% to 3.55 million bags from 3.59 million bags in January 2024, and Robustas’ exports plunged by 27.5% to 3.7 million bags from 5.1 million bags in January 2024.

By region, global exports in January 2025 decreased by 13.3% to 10.83 million bags from 12.49 million bags in January 2024. Asia and Oceania saw a significant 31.9% decline to 3.44 million bags. Africa, conversely, experienced a 7.1% increase to 1.1 million bags. South America’s exports fell by 4.2% to 5.18 million bags. Exports from Mexico and Central America rose by 10.9% to 1.1 million bags.

In the processed coffee segment, total soluble coffee exports in January 2025 decreased by 5.2% to 1.05 million bags, while roasted bean exports increased by 1.4% to 60,532 bags. These figures reflect the dynamic and complex nature of the global coffee market in early 2025.

Related Topics:

- Charlotte’s Coffee Market Heats Up as Local and National Brands Expand

- Uganda’s Coffee Sector Faces Challenges After UCDA Dissolution

- Farmer Bros. Coffee Reports Strong Q2 2025 Results Amid Challenges